Services

We tailor our services just for you, starting with the most critical needs that you prioritize. Assured Equity can help you develop strategies for the transition of your company’s ownership, create benefit packages to reward your employees, and work with your legal advisors to help arrange your estate for independence through retirement and beyond.

Find Your Financial Success

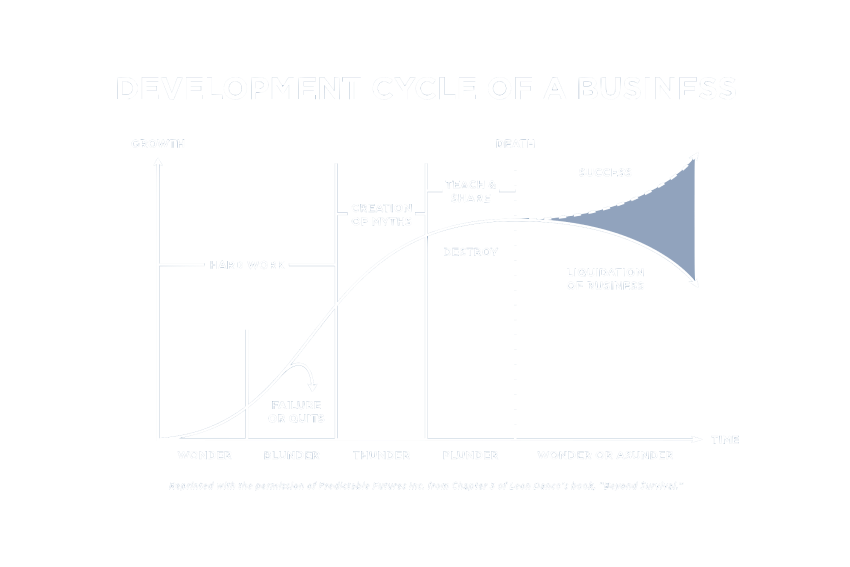

When a business opens its doors, it may struggle initially, then flourish and grow as it becomes fueled by the owner’s entrepreneurial spirit. Yet after a while—which may be years—the business can reach a plateau and stagnate. There are a number of factors that cause this, including the business becoming too large for its structure, which requires the addition of staff to take it to the next level. Depending on the efforts of the owner and other factors, the business may fail to recover, and die; or it may begin growing again. The cycle then repeats. Our goal is to help businesses and their owners through both the highs and lows of this cycle.

Building a Transition Plan

Our focus is to work with you to develop a customized strategy that meets your unique business and family needs.

Executive Benefit Packaging

Your executives are key to the growth and success of your company, so Assured Equity provides a number of ways to help you reward them without creating a financial burden.

Many companies choose to reward their key executives with supplemental executive benefit plans, including special retirement plans that enable executives to defer larger amounts of pretax income, non-qualified deferred compensation plans that can provide additional retirement income, and executive bonus plans.

Some methods may include:

Non Statutory Incentive Stock Options

Stock Appreciation Rights

Phantom Stock

Section 83 Restricted Stock Plan

401(k) Mirror Plan

Supplemental Executive Retirement Plan (SERP)

Retirement Benefit Packaging

Defined contribution plans

Profit sharing plans

Defined benefit plans

Cash balance plans

Employee Stock Ownership Plans (ESOPs)

SHANE FEIMAN

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Sed turpis tincidunt id aliquet risus feugiat in ante metus. Arcu vitae elementum curabitur vitae nunc sed velit. Varius morbi enim nunc faucibus a pellentesque sit amet. Egestas dui id ornare arcu odio ut sem nulla. Mi sit amet mauris commodo. Viverra maecenas accumsan lacus vel facilisis volutpat est velit. Lectus proin nibh nisl condimentum id. Aenean et tortor at risus viverra adipiscing. A pellentesque sit amet porttitor eget dolor morbi non arcu. Curabitur vitae nunc sed velit dignissim sodales ut. Pellentesque massa placerat duis ultricies lacus sed turpis tincidunt id. Cursus euismod quis viverra nibh cras pulvinar mattis nunc sed.

Scelerisque varius morbi enim nunc faucibus. Turpis cursus in hac habitasse platea dictumst. Velit egestas dui id ornare. Urna duis convallis convallis tellus id interdum velit. Praesent tristique magna sit amet purus. Tempus imperdiet nulla malesuada pellentesque elit. At erat pellentesque adipiscing commodo. Orci ac auctor augue mauris augue neque gravida. Vestibulum lorem sed risus ultricies tristique. Ornare aenean euismod elementum nisi quis eleifend quam adipiscing vitae. Nunc scelerisque viverra mauris in aliquam sem fringilla ut. Pellentesque elit eget gravida cum sociis natoque penatibus et magnis. Vitae elementum curabitur vitae nunc sed. Aliquam id diam maecenas ultricies mi.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Sed turpis tincidunt id aliquet risus feugiat in ante metus. Arcu vitae elementum curabitur vitae nunc sed velit. Varius morbi enim nunc faucibus a pellentesque sit amet. Egestas dui id ornare arcu odio ut sem nulla. Mi sit amet mauris commodo. Viverra maecenas accumsan lacus vel facilisis volutpat est velit.

Scelerisque varius morbi enim nunc faucibus. Turpis cursus in hac habitasse platea dictumst. Velit egestas dui id ornare. Urna duis convallis convallis tellus id interdum velit. Praesent tristique magna sit amet purus. Tempus imperdiet nulla malesuada pellentesque elit. At erat pellentesque adipiscing commodo.

Debbie joined Assured Equity in 2012 as Vice President and is also Vice President and Board Member of Donohue Feiman Retirement Plan Services, LLC.* Debbie works with individuals and business owners to help them identify and implement strategies to help them reach their financial and estate planning goals, business succession and charitable planning options. Debbie started working directly with her own clients in 2010 after designing and implementing plans on behalf of financial professionals and clients for eighteen years as the leader of the design and planning organizations of the company formerly known as AXA Equitable Life Insurance Company (AXA Equitable), which is now Equitable Advisors.

Debbie joined the financial industry in 1993 after serving eight years in the United States Air Force. Debbie received her Bachelor of Science in Business Management from the University of Maryland, European Division in 1990 in Heidelberg, Germany. She received her Juris Doctor and Masters of Law in Taxation from the University of Denver, College of Law in 1994 and 2014, respectively. Debbie also received her CERTIFIED FINANCIAL PLANNER™ professional (CFP®) certification** and a Chartered Life Underwriter (CLU).

Debbie has spoken at various national conferences on topics including estate planning, business succession, wealth transfer and charitable planning and has been published and quoted in numerous publications.

Debbie is a member of the American Bar Association (ABA), Association of Advanced Life Underwriters (AALU), Financial Planning Association (FPA), Michigan Bar Association, Colorado Bar Association, Denver Bar Association, Society of Financial Service Professionals (SFSP), and the Women’s Estate Planning Council. Debbie is also a member of the Board of Trustees of the CO-WY Chapter of the National MS Society.

Debbie and her husband, Shawn, reside in Denver, Colorado.

California Insurance License #0H61051

SEAN LORENZ

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Sed turpis tincidunt id aliquet risus feugiat in ante metus. Arcu vitae elementum curabitur vitae nunc sed velit. Varius morbi enim nunc faucibus a pellentesque sit amet. Egestas dui id ornare arcu odio ut sem nulla. Mi sit amet mauris commodo. Viverra maecenas accumsan lacus vel facilisis volutpat est velit.

Scelerisque varius morbi enim nunc faucibus. Turpis cursus in hac habitasse platea dictumst. Velit egestas dui id ornare. Urna duis convallis convallis tellus id interdum velit. Praesent tristique magna sit amet purus. Tempus imperdiet nulla malesuada pellentesque elit. At erat pellentesque adipiscing commodo.

SHANE FEIMAN

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Sed turpis tincidunt id aliquet risus feugiat in ante metus. Arcu vitae elementum curabitur vitae nunc sed velit. Varius morbi enim nunc faucibus a pellentesque sit amet. Egestas dui id ornare arcu odio ut sem nulla. Mi sit amet mauris commodo. Viverra maecenas accumsan lacus vel facilisis volutpat est velit. Lectus proin nibh nisl condimentum id. Aenean et tortor at risus viverra adipiscing. A pellentesque sit amet porttitor eget dolor morbi non arcu. Curabitur vitae nunc sed velit dignissim sodales ut. Pellentesque massa placerat duis ultricies lacus sed turpis tincidunt id. Cursus euismod quis viverra nibh cras pulvinar mattis nunc sed.

Scelerisque varius morbi enim nunc faucibus. Turpis cursus in hac habitasse platea dictumst. Velit egestas dui id ornare. Urna duis convallis convallis tellus id interdum velit. Praesent tristique magna sit amet purus. Tempus imperdiet nulla malesuada pellentesque elit. At erat pellentesque adipiscing commodo. Orci ac auctor augue mauris augue neque gravida. Vestibulum lorem sed risus ultricies tristique. Ornare aenean euismod elementum nisi quis eleifend quam adipiscing vitae. Nunc scelerisque viverra mauris in aliquam sem fringilla ut. Pellentesque elit eget gravida cum sociis natoque penatibus et magnis. Vitae elementum curabitur vitae nunc sed. Aliquam id diam maecenas ultricies mi.

JOSHUA FEIMAN

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Sed turpis tincidunt id aliquet risus feugiat in ante metus. Arcu vitae elementum curabitur vitae nunc sed velit. Varius morbi enim nunc faucibus a pellentesque sit amet. Egestas dui id ornare arcu odio ut sem nulla. Mi sit amet mauris commodo. Viverra maecenas accumsan lacus vel facilisis volutpat est velit.

Scelerisque varius morbi enim nunc faucibus. Turpis cursus in hac habitasse platea dictumst. Velit egestas dui id ornare. Urna duis convallis convallis tellus id interdum velit. Praesent tristique magna sit amet purus. Tempus imperdiet nulla malesuada pellentesque elit. At erat pellentesque adipiscing commodo.

Debbie joined Assured Equity in 2012 as Vice President and is also Vice President and Board Member of Donohue Feiman Retirement Plan Services, LLC.* Debbie works with individuals and business owners to help them identify and implement strategies to help them reach their financial and estate planning goals, business succession and charitable planning options. Debbie started working directly with her own clients in 2010 after designing and implementing plans on behalf of financial professionals and clients for eighteen years as the leader of the design and planning organizations of the company formerly known as AXA Equitable Life Insurance Company (AXA Equitable), which is now Equitable Advisors.

Debbie joined the financial industry in 1993 after serving eight years in the United States Air Force. Debbie received her Bachelor of Science in Business Management from the University of Maryland, European Division in 1990 in Heidelberg, Germany. She received her Juris Doctor and Masters of Law in Taxation from the University of Denver, College of Law in 1994 and 2014, respectively. Debbie also received her CERTIFIED FINANCIAL PLANNER™ professional (CFP®) certification** and a Chartered Life Underwriter (CLU).

Debbie has spoken at various national conferences on topics including estate planning, business succession, wealth transfer and charitable planning and has been published and quoted in numerous publications.

Debbie is a member of the American Bar Association (ABA), Association of Advanced Life Underwriters (AALU), Financial Planning Association (FPA), Michigan Bar Association, Colorado Bar Association, Denver Bar Association, Society of Financial Service Professionals (SFSP), and the Women’s Estate Planning Council. Debbie is also a member of the Board of Trustees of the CO-WY Chapter of the National MS Society.

Debbie and her husband, Shawn, reside in Denver, Colorado.

California Insurance License #0H61051

SEAN LORENZ

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Sed turpis tincidunt id aliquet risus feugiat in ante metus. Arcu vitae elementum curabitur vitae nunc sed velit. Varius morbi enim nunc faucibus a pellentesque sit amet. Egestas dui id ornare arcu odio ut sem nulla. Mi sit amet mauris commodo. Viverra maecenas accumsan lacus vel facilisis volutpat est velit.

Scelerisque varius morbi enim nunc faucibus. Turpis cursus in hac habitasse platea dictumst. Velit egestas dui id ornare. Urna duis convallis convallis tellus id interdum velit. Praesent tristique magna sit amet purus. Tempus imperdiet nulla malesuada pellentesque elit. At erat pellentesque adipiscing commodo.

Financial Strategies

Minimally impacted by estate transfer taxes and other costs

Distributed with as little delay and paperwork as possible

Settled without the involvement of probate court proceedings

An estate plan strategy designed by Assured Equity may include:

Asset preservation planning

A charitable giving plan

A plan to help you manage your affairs in the event of your incapacity

Other personal and financial strategies that are considered, reviewed and developed when appropriate include:

Multi-generational wealth transfer planning

Insurance planning, including long-term care

College funding for children and grandchildren

Investment and portfolio strategies

Risk management

1800 Glenarm Pl, #900

Denver, CO 80202

Phone: 303-892-5701

Securities and Investment Advisory Services Offered Through M Holdings Securities, Inc. A Registered Broker/Dealer and Investment Advisor, Member FINRA/SIPC. AEM Partners, LLC dba Assured Equity is independently owned and operated. AEM Partners, LLC dba Assured Equity is a member of M Financial Group. Please go to mfin.com/DisclosureStatement.htm for further details regarding this relationship.

Check the background of this firm and/or investment professional on FINRA's BrokerCheck

For important information related to M Securities, refer to the M Securities' Client Relationship Summary (Form CRS) by navigating to mfin.com/m-securities.

Registered Representatives are registered to conduct securities business and licensed to conduct insurance business in limited states. Response to, or contact with, residents of other states will only be made upon compliance with applicable licensing and registration requirements. The information in this website is for U.S. residents only and does not constitute an offer to sell, or a solicitation of an offer to purchase brokerage services to persons outside of the United States.

This site is for information purposes and should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney, financial or tax advisor or plan provider.

#5882585.1